Review: Curve (All-in-one Wallet & Bank Card)

Discover the app that makes your life easier while giving you cashback

Curve: General Information

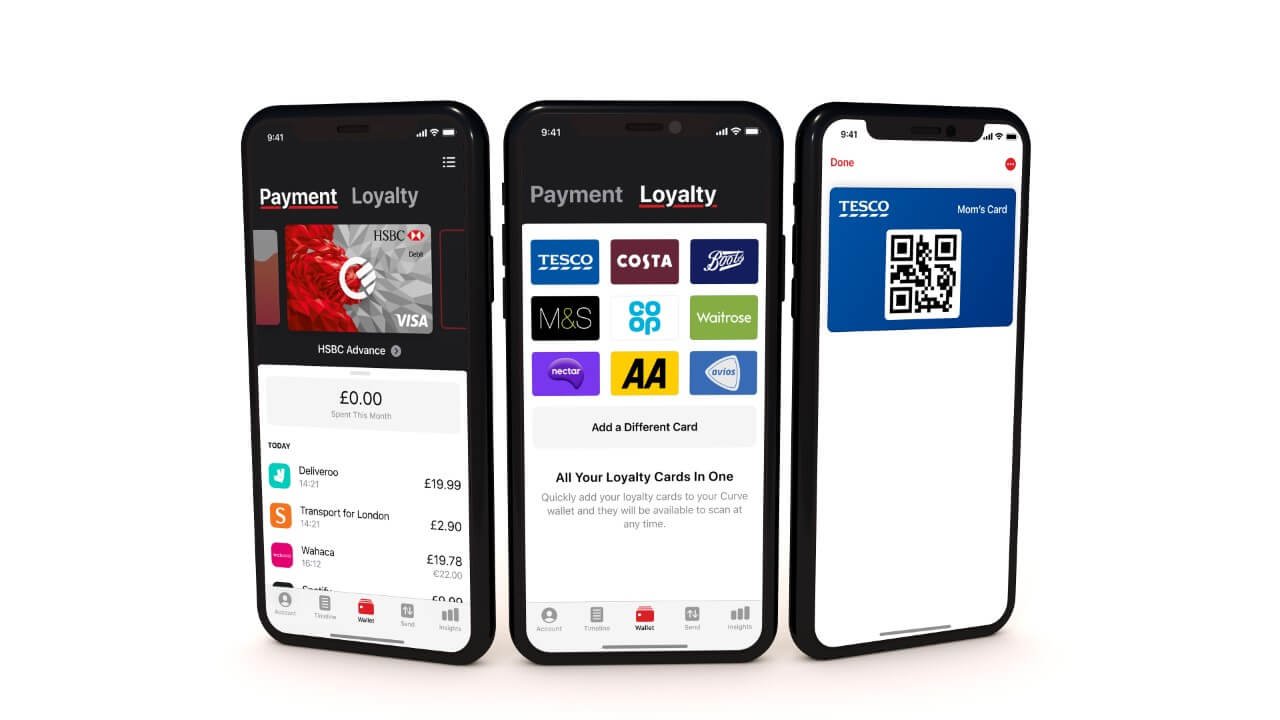

Curve is a financial management platform that allows users to connect all of their debit and credit cards into one place, giving them the ability to track their spending, earn rewards, and manage their finances more easily. Curve's app conveniently aggregates all your bank cards in a single one and gives you smart ways to manage your spending, powered by it's modern mobile app.

The fintech was founded by Shachar Bialick back in 2015 who strives to make Curve the "Amazon of banking" by removing the need to dig through your wallet for the right card to use. Curve also offers customers numerous other benefits on top of its core card aggregation proposition. These include, but are not limited to: budgeting insights (thanks to automatic categorization of your payments), cashback, partner rewards and a lot more.

With an ambitious goal of becoming the one-stop-shop for managing your cards and related apps in a much simpler way. Does it succeed in doing that? Three of our in-house digital finance experts downloaded the Curve app, ordered their cards and we're ready to share a summary of their assessments in this Curve app review.

Curve: Key Facts

| Founded | 2015 |

|---|---|

| Headquarters | London, UK |

| Total Users | 2'000'000+ |

| Website | curve.com |

| Personal Banking | Free plan available |

| Business Banking | ❌ |

| Sign-up Bonus | ❌ |

| Joint Accounts | ❌ |

| Desktop Version | ❌ |

In this Curve card review, we'll explain how the service works in a simple step-by-step guide, go over various subscriptions (plans) available and provide you with a Curve plan comparison table. We'll conclude with a list of all benefits and drawbacks there are to using this service before finishing it off with a short summary and our verdict. For our visitors from the UK, we we also suggest taking the time to check out our Guide to Banking in the UK - this knowledge can save you money!

Curve cards are not only stylish, but also have an unusual shape.

But before we jump into the review, we have to mention that Curve was previously featured in the following features of our "Ratings, Guides & Featured Articles by Finance Experts" section:

Curve: Countries Supported

Curve is available for citizens and residents of the following countries:

Austria

Belgium

Bulgaria

Croatia

Cyprus

Czechia

Estonia

France

Germany

Greece

Hungary

Ireland

Italy

Latvia

Lithuania

Luxembourg

Malta

Netherlands

Poland

Portugal

Slovakia

Slovenia

Spain

Denmark

Finland

Norway

Sweden

Romania

UK

Iceland

Curve Plans

The app offers several different plans to choose from, each with its own unique set of features and benefits. We will briefly mention the plans currently available below and provide a plan comparison table for your convenience.

Curve

No monthly cost

This is the basic, no-cost version of the app that allows you to connect and track your debit and credit cards (however, just 2 of them), view their transaction history, and receive notifications whenever a purchase is made using these. At no cost, you get unlimited "Anti-Embarrassment Mode" (essentially, an ability to designate a "backup card" that will be used for the transaction in case the card you're trying to pay with gets declined), an ability to "Go Back In Time" with your purchases (we've previously noted in our list of the most exciting features in digital finance apps) and £200 of fee-free ATM withdrawals abroad a month. Great value for simply downloading the app and a smooth introduction to the Curve world.

Curve X

£4,99

Curve X includes everything in the previous plan, adding in 5 "Smart Rules" (an ability to set up rules on what payments should be made with each of the cards: e.g. groceries from one, bars from another, digital purchases from a third one), an ability to also add business cards and extending "Your Cards in One" feature to up to 5 cards of your choosing.

Bank Accounts for Individuals

Read our detailed reviews of personal bank accounts available at some of the world's most popular online banks, compare the plans they offer, explore their pricing and discover all the hidden fees.

Curve Black

£9,99

Premium subscription that is a real digital finance powerhouse. Unlimited cards in a single app, 90 days of going back in time, £400 fee-free withdrawals abroad a month and unlimited smart rules. On top of it, you get unlimited 1% cashback at 3 retailers of your choice and zero transaction fees on all payments abroad. Oh, and speaking of traveling: you also get extensive travel insurance for any trip you book using your Curve card.

Curve Metal

£14,99

The Metal plan is the top-tier offering from Curve, and includes all of the features of the "Black" plan, as well as exclusive rewards, concierge services, and special offers from selected partners. It also includes a stylish metal card we mentioned in our overview of the best metal bank cards available in Europe today. you can use as their primary payment method - and it's definitely going to make some heads turn!

And if that wasn't enough, you also get cell phone insurance, car hire excess insurance and access to airport lounges worldwide, thanks to your LoungeKey. A proper VIP service for a demanding "citizen of the world".

Now that we've covered the various plans available, please find the Curve plan comparison table below. Interested in trying Curve out? Just follow the link to get started with Curve in no time.

Curve: Plan Comparison Table

| Curve | Curve X | Curve Black | Curve Metal | |

|---|---|---|---|---|

| Price, p/m | - | £4,99 | £9,99 | £14,99 |

| Cards | ||||

| Connected Cards | 2 cards | 5 cards | Unlimited | Unlimited |

| Business Cards | ||||

| Metal Card | ||||

| Card delivery | £4,99 | Free | Free | Free |

| Go Back in Time | 30 days | 60 days | 90 days | 120 days |

| Payment Methods | ||||

| Apple Pay | ||||

| Google Pay | ||||

| Samsung Pay | ||||

| Currency Exchange | ||||

| Fee-free FX Limit | £1'000 | £2'000 | Unlimited | Unlimited |

| Fee-free ATMs abroad, p/m | £200 | £200 | £400 | £600 |

| Cashback | ||||

| 1% Cashback | 3 retailers | 6 retailers | ||

| Crypto rewards | BTC Only | |||

| Insurance | ||||

| Travel Insurance | ||||

| Mobile Phone | ||||

Starting 10.06.2023, Curve announced a change in terms of service, introducing new fee-free monthly allowance for customers who want to use their Curve Business card on their personal plan. Below are the limits and the fees that apply after hitting these limits:

| Plan | Fee | Fee-free Monthly Limit |

|---|---|---|

| Curve Metal | 1,5% transaction fee | €1500 |

| Curve Black | 1,5% transaction fee | €1000 |

| Curve X | 1,5% transaction fee | €500 |

| Curve | 1,5% transaction fee | €100 |

Multiply Your Wealth

Doesn't matter if you're just saving up for that summer vacation or if you're planning your retirement, the best time to start investing is now. Explore our curated list of the best investment platforms and apps available today at Fintech Compass. Make your money work so you don't have to.

How To Use Curve

Using Curve is insanely easy - we've tested it, it will not take you more than 5 minutes to get used to it once you download the Curve app. However, Curve is a unique service and the benefits sometimes sound "too good to be true", so a little explanation would be helpful. Which is why our experts created a simple step-by-step chart to assist our readers.

Download the Curve app

Available on both iOS and Android, the app can be downloaded by following the links in our review.

Choose the plan and card you want

Don't worry - this selection can be changed at any time, and the card itself is free (but for free plan users, card delivery will cost £4,99). Luckily, you can just use a virtual card that is free for all users. After all, this card can be used with Apple Pay, Google Pay and Samsung Pay just fine.

Add your cards

Just scan your cards to upload them to your new digital wallet. Don't worry - Curve uses cutting-edge security mechanisms while your funds are covered for up to £100'000 thanks to customer deposit protection every licensed financial institution has.

Pay like you normally would

Pay with your physical card or keep using your phone to do contactless payments - whatever suits you. That's it! You can now enjoy all the benefits of your chosen plan: cashback, "Go Back In Time", fee-free foreign ATM withdrawals and a lot more!

Curve: Pros & Cons

Advantages

- Works with any bank: it is an app that will salvage your situation when you're committed to a bank (say, by having a mortgage) that is stuck in middle ages.

- Centralize everything: Using one card for air miles, another for digital purchases and a third one for cheap ATM withdrawals is smart. Curve adds convenience to the mix.

- Go Back In Time: Bought an airline ticket using the wrong bank card and missed out on a ton of miles? Not an issue.

- Anti-Embarassment Mode: Set up a backup card and you'll never find yourself franticly going through a heap of cards with a queue behind you.

Downsides

American Express? "Unfortunately not", says Curve - at least for now.

American Express? "Unfortunately not", says Curve - at least for now. But the banking apps? Curve solves the wallet-too-thick problem, though we can't help but ask: could we only need just one banking app for all our financial needs from different providers?

But the banking apps? Curve solves the wallet-too-thick problem, though we can't help but ask: could we only need just one banking app for all our financial needs from different providers?

Frequently Asked Questions

How long does it take for Curve card to arrive?

Average delivery time for the Curve card is 3-5 business days. This can, however, vary based on your location. The delivery is free of charge if you're on any of the plans with a monthly subscription cost, but it will cost free plan users £4,99 (or local equivalent).

Which countries is Curve available in?

Curve is available for UK residents and anyone who lives in any of the 30 EEA (European Economic Area) countries.

Is there a limit to "Go Back In Time" feature?

There are two limits: time frame and total amount. Time frame limit varies by plan, starting at 30 days with the free subscription and is capped at 120 days for the "Curve Metal" plan. The maximum transaction amount is set at £5'000.

Which cards does Curve support?

Curve supports all major debit and credit cards: Mastercard, Visa, Diners Club and Discover. Unfortunately, American Express cards are not supported by Curve yet.

Does Curve has Apple or Google Pay?

Yes, Curve card can be easily added to Apple Pay, Google Pay and Samsung Pay. However, Google & Samsung restrict availability of their services to select countries - make sure to check the local app store's Curve app listing to find out.

Summary: Is Curve worth it?

UK is home to some of the biggest and the most promising neobanks and financial services companies like Europe's biggest digital bank Revolut and Monese mobile bank. After experiencing how Curve works, we can confidently state that Curve successfully solves the issue of having too many bank. If this is something you struggle with, we would recommend you to at least give it a try. The basic subscription is also completely free and will give you a full understanding of what's Curve about, and "Go Back in Time" is for sure an outstanding feature (and not only because of its name!).

Our experts' final assessment is this: while the Black & Metal subscriptions are slightly overpriced for all but the heaviest bank card users, they can still be extremely beneficial and cost-efficient for some people. Ultimately, whether or not the Curve app is worth it will depend on the individual user's financial needs and goals. For those who frequently travel or make a lot of overseas purchases, the ability to use their card without incurring additional fees could be a major selling point. Similarly, those who are looking to earn cashback or other rewards on their everyday spending might find the Black or Metal plans more appealing. And the metal card by Curve is surely quite a fashion statement!

Overall, the Curve app is a solid choice for anyone looking to streamline their finances and make the most of their spending. Its wide range of features and customizable plans make it a versatile tool that can meet the needs of a variety of users.