Review: Qonto (Bank Accounts for Businesses)

Pay and get paid, invoice and manage expenses with Qonto

What is Qonto? Short introduction

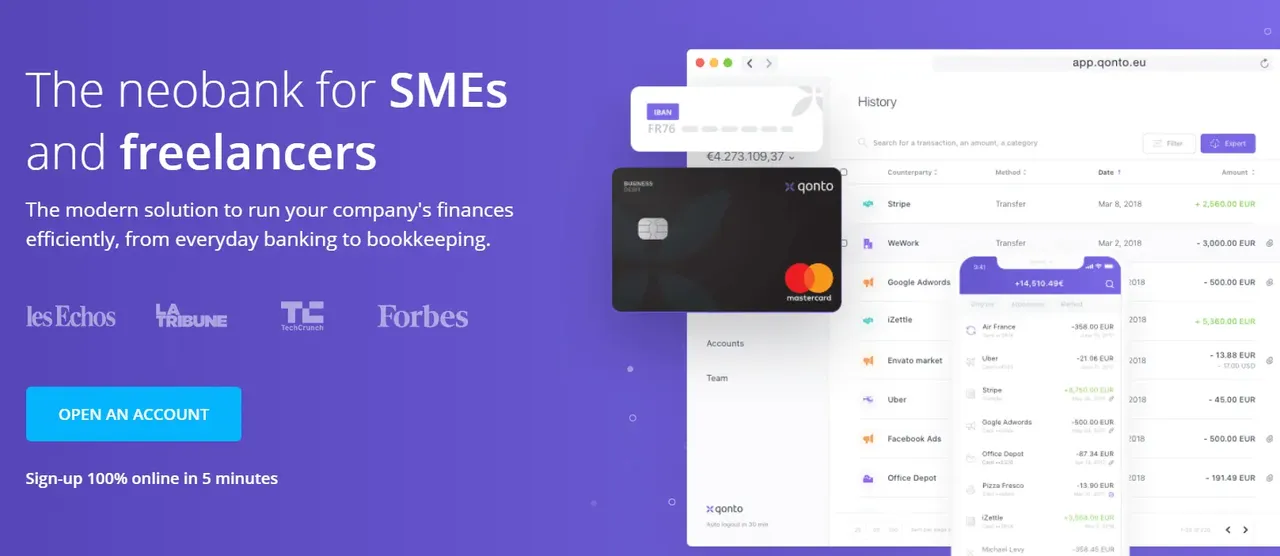

Qonto is an up-and-coming French financial technology company headquartered in Paris, France. Born "out of frustration with a lack of options", the company's mission is to reinvent business banking by using design and technology to give entrepreneurs the best possible banking experience.

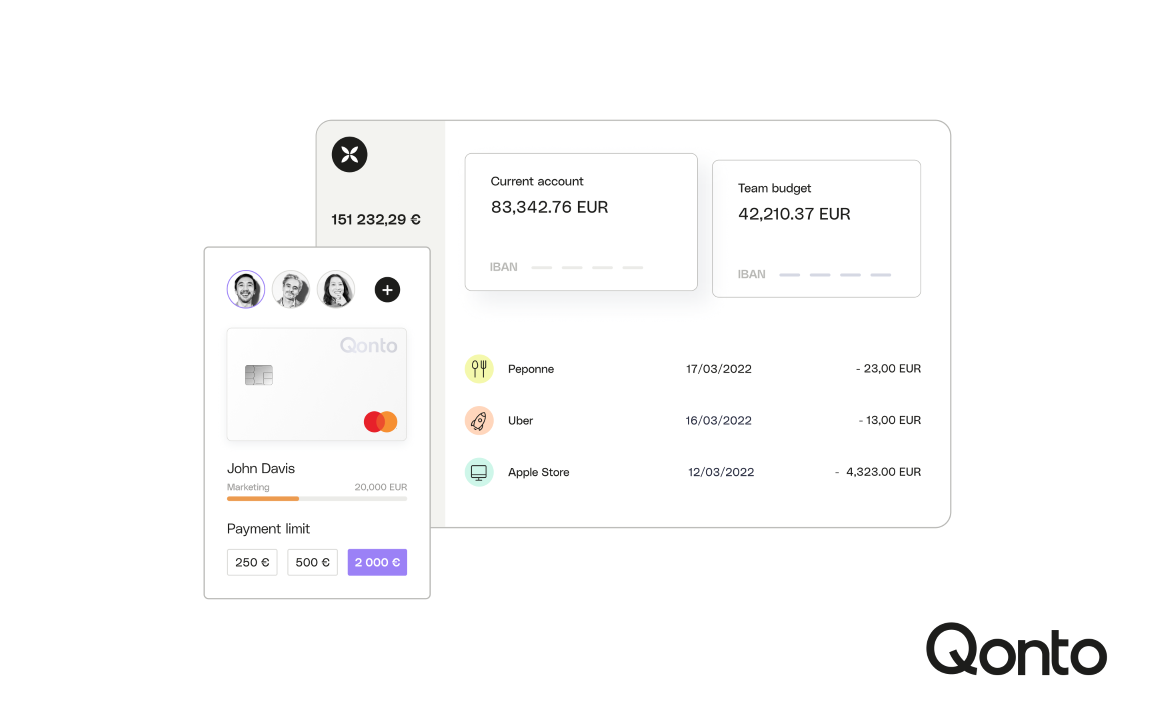

Geared towards ambitious startup founders, small business owners, freelancers and digital entrepreneurs, the company aims to make business finance easy, while still providing a reliable and powerful banking product. Qonto's approach to winning over customers is very straightforward: first, you offer customers a bank account on par with the ones at traditional "brick-and-mortar" banks. Then, you utilize cutting-edge technology to enhance security, supplement that with convenience of digital-first services, and package that in a very stylish and user-friendly interface (either on desktop or in a mobile app).

Qonto: Key Facts

| Founded | 2016 |

|---|---|

| Headquarters | Paris, FR |

| Customers | 150'000+ |

| Website | qonto.com |

| Personal Banking | ❌ |

| Business Banking | From €9.00 p/m |

| Sign-up Bonus | 30 days free trial |

| Web Client | ❌ |

But does Qonto actually manage to deliver on that promise? To answer with certainty, our team of experts assessed Qonto's business banking solutions by getting "hands-on" with the mobile app and reviewing all relevant pricing and legal documents. The results of their critical examination are in this article.

First, we delve into the intricacies of Qonto's offerings, evaluating how well it meets the needs of its target audience and stands out in the crowded fintech space. Whether you're a freelancer tired of traditional banking hurdles or a growing business in search of a financial platform that grows with you, join us as we explore what makes Qonto a potential game-changer in business banking and criticize all the shortcomings this neobank has.

Looking to compare the best business banking offers available today? Qonto's bank accounts for companies are also featured in our selection of in-depth "one-on-one" comparisons. Find the list of comparisons of Qonto bank accounts by going to the links below:

Qonto: Availability per country

Legal business entities registered in the following countries can sign up for a Qonto bank account for businesses:

France

Germany

Italy

Spain

Qonto's bank cards boast a stylish design and come in a variety of colors.

Plans Available at Qonto

Qonto primarily services four audience segments, providing a selection of three plans for each group. From self-employed and freelancers to enterprise-level corporations, we'll dive into the differences between what's available to Qonto's customers below.

Company Creation with Qonto

If you're just getting started and are looking to create a new company in France, Qonto provides three "all-inclusive" packages to choose from. Each of these allows you to cut down on the amount of paperwork, ensures you receive your deposit certificate within 72 hours and gives your newly created venture a ready-to-use bank account (fully paid for the next 12 months). Of course, you also get your Mastercard, 7 days a week customer support, 3D Secure and a modern mobile app that's intuitive and aesthetically pleasing. You obviously get a Qonto RIB with your IBAN details, Qonto's BIC and all other information you might need.

Here are the benefits included in each of Qonto's company creation packages.

All prices indicated below include the initial deposit fee; VAT not included

Basic Pack

€169,- for Year 1; €108,- after Year 1

Company creation, deposit fee and your bank account ready to go. Clearly aimed at self-employed and freelancers, the biggest restriction is that you're limited to only one bank account, without any sub-accounts for easier cash flow and expense management. You get 30 transfers or direct debits per month included, and you're limited to €20'000 of card payments a month.

Multiply Your Wealth

Doesn't matter if you're just saving up for that summer vacation or if you're planning your retirement, the best time to start investing is now. Explore our curated list of the best investment platforms and apps available today at Fintech Compass. Make your money work so you don't have to.

Smart Pack

€289,- for Year 1; €228,- after Year 1

Biggest improvements over Basic:

- Accountant access + Automated bookkeeping tools

- [New!] Integrated invoicing tool access & 80+ other integrations

- 60 transfers/DDs a month for free; €60'000 p/m limit on payments

- Unlimited virtual cards, bulk transfers & advanced dashboard

This option definitely provides the most value per euro spent on fees.

Essential Pack

€399,- for Year 1; €348,- after Year 1

On top of everything included in the Smart Pack, you get:

- 100 SEPA transfers or direct debits & 5 checks cashed free each month

- 2 Mastercard bank cards & unlimited virtual cards

- 4 more bank-accounts for free and full account access for 2 team members

"Essential" really only makes sense if you expect a high transaction volume in the first year, and having two users with full account access is a deal-breaker for you. Otherwise, you're better off sticking to "Smart" and reinvesting the difference in your business.

Self-Employed & Freelancers

For entrepreneurs and professionals with an existing business entity, Qonto offers a selection of three plans. They are:

- Qonto Basic: €9,-/mo - covers your basic business banking needs

- Qonto Smart: €19,-/mo - less restrictions, invoicing and bookkeeping tools

- Qonto Premium: €39,-/mo - highest limits, all features and priority support

Prices shown for annual billing cycle, VAT excluded.

You can compare and contrast these three plans in our comparison table below. Keep in mind that users signing up for Qonto using any of the links provided in this article are eligible for 30-day trial and get a 20% discount when billed annually!

Qonto: Plan Comparison Table (Business)

| Feature | Basic | Smart | Premium |

|---|---|---|---|

| Price, per month | € 9.00 | € 19.00 | € 39.00 |

| Commitment | Cancel monthly | Cancel monthly | Cancel monthly |

| Sign-up bonus | 30 days free trial | ||

| Website | qonto.com | ||

| Accounts | |||

| IBANs | FR, IT, DE, ES | FR, IT, DE, ES | FR, IT, DE, ES |

| Sub-accounts included | 1 | 2 | 5 |

| Shared Access | ❌ | ❌ | ❌ |

| Employee Accounts | ❌ | ❌ | ❌ |

| Mobile Payments | |||

| Apple Pay | ✔️ | ✔️ | ✔️ |

| Google Pay | ✔️ | ✔️ | ✔️ |

| Samsung Pay | ❌ | ❌ | ❌ |

| Other methods | - | - | - |

| Cards | |||

| Cards available | Mastercard | Mastercard | Mastercard |

| Cards included | 1 | 1 | 1 |

| Maestro/VPay | ❌ | ❌ | ❌ |

| Debit cards | ✔️ | ✔️ | ✔️ |

| Credit cards | ❌ | ❌ | ❌ |

| Virtual cards | ✔️ | ✔️ | ✔️ |

| Extra card fee | € 2.00 p/m | - | - |

| Replacement fee | € 10.00 | € 10.00 | € 10.00 |

| Free replacements | - | - | - |

| Metal card | ❌ | ❌ | ❌ |

| Wooden cards | ❌ | ❌ | ❌ |

| Payment Methods | |||

| iDeal | ❌ | ❌ | ❌ |

| SOFORT | ❌ | ❌ | ❌ |

| Bancontact | ❌ | ✔️ | ✔️ |

| Various Fees | |||

| SWIFT (receive) | € 5.00 | € 5.00 | N/A |

| Foreign exchange fee | 0.80% | 0.70% | 0.70% |

| Currency fee-free limit | - | - | - |

| ATM Withdrawals | |||

| Daily limit | € 1,000 | € 2,000 | € 3,000 |

| Free withdrawals, per month | - | - | - |

| After that, per withdrawal | € 1.00 | € 1.00 | € 1.00 |

| Withdrawal fee abroad | € 1.00 | € 1.00 | € 1.00 |

| Interest Rate | |||

| Current accounts | ❌ | ❌ | ❌ |

| Savings accounts | ❌ | ❌ | ❌ |

| Transaction & Deposit Limits | |||

| Deposit limit | € 60,000 | € 80,000 | € 80,000 |

| Deposit Protection | Up to €100'000 | ||

| Monthly spend limit | € 20,000 | € 60,000 | € 60,000 |

| Other financial products | |||

| Overdraft | ❌ | ❌ | ❌ |

| Investments in-app | ❌ | ❌ | ❌ |

| Crypto trading | ❌ | ❌ | ❌ |

| Cheques | Up to €30,000 | Up to €30,000 | Up to €30,000 |

| Cashback | ❌ | ❌ | ❌ |

| Insurance | ❌ | ❌ | ❌ |

| Lounge access | ❌ | ❌ | ❌ |

| Transaction categorization | ✔️ | ✔️ | ✔️ |

| Purchase protection | ❌ | ❌ | ❌ |

| Round-up savings | ❌ | ❌ | ❌ |

| Cash Flow Control | ❌ | ✔️ | ✔️ |

| Deals & Discounts | ✔️ | ✔️ | ✔️ |

| Other benefits | Cash flow dashboard | Supplier management | Invoicing tool |

| Learn more |

Go to qonto.com

| ||

Plans for Micro-Businesses (<10 employees)

Expanding your business beyond just being a one-man operation is tough. This business segment frequently feels underbanked, so seeing a whole range of options for micro-businesses is refreshing.

However, in reality, none of these plans are unique or new. "Qonto Essential" is the same plan as the one offered to companies created via the "Essentials Pack", while the two other options, "Business" and "Enterprise" are exactly the same plans as the ones offered to larger businesses (read below!). Doesn't mean they're bad plans, but it might be a bit misleading!

Qonto for SMEs (10-250+ employees)

For an established business with dozens of employees, the French neobank also offers three plans to choose from. Each of these comes with a dedicated account manager, priority 7 days-a-week customer support and 80+ exclusive integrations with third party financial tools.

The three "heavy hitters" are:

- Business: €99,-/mo - access for 10 team members, invoicing & supplier payments, automated bookkeeping tools, expense reports, cash flow monitoring and 10 bank cards with customizable limits and permissions for each.

- Enterprise: €249,-/mo - access for up to 30 users & 30 bank cards included in your monthly fee, 24 sub-accounts for budgeting, 1000 SEPA transfers a month (very linear upgrade over Business)

- Custom Plan: Unique banking needs or impressive business scale? You can build your company's own plan and Qonto will make it happen.

Prices shown for annual billing cycle, VAT excluded.

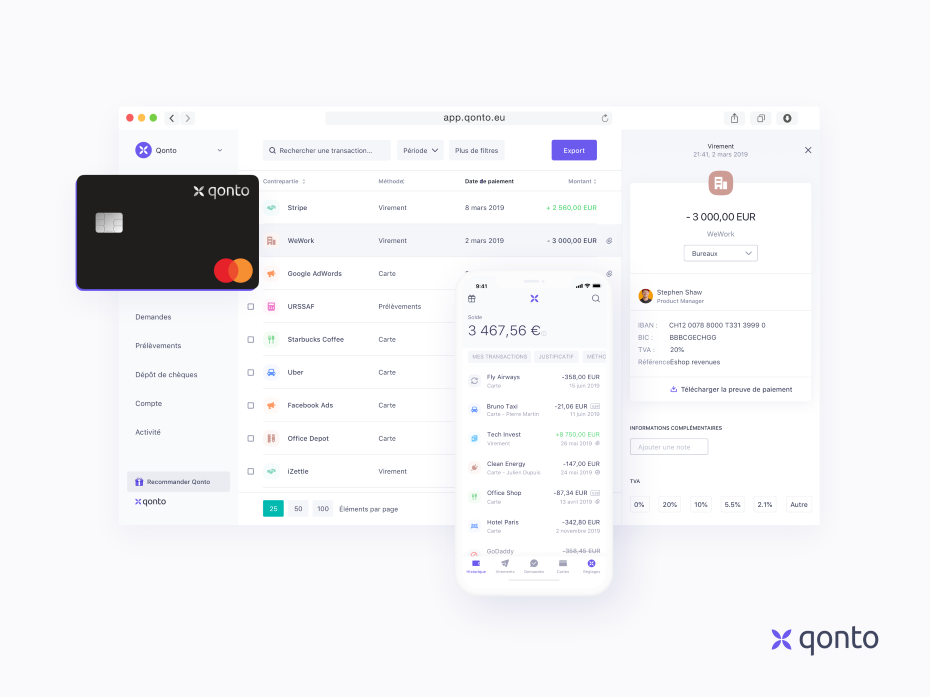

Qonto's apps on both mobile and desktop have a convenient and neat UI.

Qonto: Pros & Cons

Advantages

The French fintech offers a wide range of financial products and offers impressive flexibility, thanks to its wide selection of plans. Here are the top benefits that might make you consider Qonto as your company's bank.

- Best of Both Worlds: Even though Qonto positions themselves as a digital-first and very mobile bank, you can still get your fix of face-to-face interaction thanks to an ability to get in touch with your individual account manager.

- Bookkeeping Made Easy: Thanks to dozens of integrations already built and tens of others coming soon, automating the boring parts of your business has never been easier!

- Expenses & Cash Flow Management: Set transaction limits for each of your cards online in just a few clicks. You can easily keep track of all related expenses in real-time.

- Easy Switching: Qonto offers the first-ever bank mobility service for professionals (that's how they call businesses in France). For bigger companies, a dedicated "switch support" team is available.

Downsides

However, Qonto isn't perfect either. Below are some of the shortcomings and downsides of its banking product anyone interested in signing up for Qonto should keep in mind.

Not a Bank (Technically): Qonto is not a bank but a payment institution supervised by the Banque de France. Customers' funds are secured with Crédit Mutuel Arkéa and covered by the 'Fonds de Garantie des Dépôts et de Résolution' (FGDR) up to €100,000. That's also why cash deposits are not allowed at Qonto, just like loans or overdraft options.

Not a Bank (Technically): Qonto is not a bank but a payment institution supervised by the Banque de France. Customers' funds are secured with Crédit Mutuel Arkéa and covered by the 'Fonds de Garantie des Dépôts et de Résolution' (FGDR) up to €100,000. That's also why cash deposits are not allowed at Qonto, just like loans or overdraft options. Expensive: Despite an impressive product portfolio and a few unique features, Qonto still comes out quite a bit pricier than most other digital-first options, in line with other French banks.

Expensive: Despite an impressive product portfolio and a few unique features, Qonto still comes out quite a bit pricier than most other digital-first options, in line with other French banks. Too French For Some: Despite being available in multiple countries, Qonto still has a French-first focus, so you might encounter some imperfections in app's localization.

Too French For Some: Despite being available in multiple countries, Qonto still has a French-first focus, so you might encounter some imperfections in app's localization. SEPA Transfers & Direct Debit Limit: You'd expect these to be unlimited when paying tens of euros a month, yet there's a limit to free operations each month.

SEPA Transfers & Direct Debit Limit: You'd expect these to be unlimited when paying tens of euros a month, yet there's a limit to free operations each month.

Bank Accounts for Businesses

Time is money if you're a business owner, franchisee or a freelancer. Discover modern mobile-first bank accounts for companies of any scale and explore unique features and products built for digital-native business owners.

Qonto: F.A.Q.

As with any pricing structure offered by a French bank, Qonto's product is riddled with minor nuances and technicalities. It's not easy to wrap your head around these, so we want to clear up any confusion our visitors experience in this "frequently asked questions" section.

Is Qonto a real bank? Is it safe?

Olinda SAS (the payment institution using "Qonto" as a trade name) is regulated and is overseen by the French Prudential Control and Resolution Authority (ACPR). This authority is representing Banque de France and supervises all of the French banks.

Qonto routinely undergoes finanical and IT audits by the regulators and is subject to countless types of reporting and scrutiny. As an additional legal requirement, all user deposits (up to €100'000 per customer) are insured by the French Deposit Guarantee and Resolution Fund (FGDR). This ensures that the funds in your Qonto accounts are 100% safe at all times.

Can I use Qonto if my business deals in crypto?

In case your businesses' main activities involve storing, purchasing or exchanging digital assets (cryptocurrencies, NFTs and other non-fiat assets), you can still use Qonto. However, you would only be able to use the bank account for your administrative expenses, such as making salary payments to employees, paying your company's bills, etc.

Unfortunately, you would not be able to use your Qonto bank account for transactions to and from customers and/or payments that incur as a consequence of operating platforms used to distribute these assets.

Who can open a Qonto account on behalf of the company?

You can apply to register your Qonto bank account as one of the following:

- Company's director

- Association or cooperative's chairman

- In case you have a proxy

When in doubt - reach out to Qonto's support team!

Can you have virtual cards at Qonto?

Yes, Qonto customers can get an unlimited number of Mastercard debit virtual cards. These cards support contactless payments, Apple Pay and Google Pay, so you can use them both online and in physical stores. Keep in mind, however, that there is a spending limit of €20'000 per month per card.

Can I receive SWIFT payments with Qonto?

Yes, it is possible to receive SWIFT transactions with Qonto. On top of this, not only can you get paid in euro, but you can also do so in 25+ other currencies, including US Dollars, Japanese Yen, Polish Zloty and more. SWIFT transactions take up to 5 business days to arrive in your account. These are facilitated by an intermediary financial services company, Wise, that specializes in cross-border payments.

What are Qonto Flash Cards?

Flash cards are disposable virtual Mastercard debit cards that aim to be the perfect solution for teams' one-off expenses. Using flash cards enables you to streamline the payment experience for standalone purchases. You can set a budget and a duration specific to the exact need, whether it's covering the employee travel expenses or paying for a dinner with your colleagues.

Using Flash cards, it is also possible to pay online or offline by adding it to Google Pay / Apple Pay. Flash cards expire automatically on the date chosen when setting one up, so you do not need to worry about disabling one after you succeed with your transactions. Flash cards offer the same insurance, assistance benefits, and billing as Qonto One cards.

Qonto: Alternatives to consider

Does the product portfolio of Qonto lack something you are explicitly looking for? Perhaps, you are looking for a company account in a different price range? Or do you want to find a more powerful solution for your needs? Below, we will provide you with three Qonto alternatives other users found relevant.

Finom

Finom is a Dutch financial technology company and an "all-in-one expense management, invoicing and cash flow monitoring solution". It comes at a reasonable price point and is better suited for companies looking to continue using their existing bank accounts. Thanks to Open Banking, you can connect all your banks to your Finom account and enjoy a convenient and complete cash flow overview in a modern UI. Finom also has a free plan available - and that comes with a standalone IBAN, so it's definitely worth a try!

Finom

Finom offers digital banking with built-in invoicing and expense management solutions for freelancers, self-employed and entrepreneurs, SMEs and companies under registration.

General Information

- Deposit ProtectionUp to €100'000

- Customer SupportChat, Whatsapp, Email

- CurrenciesEUR

Bank Accounts

- Individuals

- Businesses Free plan available

- Joint

- Convenience & User-friendliness

- Customer Support

- Features Available

- Value for Money

- Overall Rating

bunq

If you're running an online business, rarely receive cash payments and (rightfully so) consider cheques to be as outdated as VHS tapes or fax machines, bunq might just be the bank for you. Latest Dutch fintech unicorn available to businesses all over the EU enjoyed explosive growth in the last years, and it's easy to see why. Affordable plans, up to 25 sub-accounts each with its individual IBAN for easy cash flow management, mobile-first approach and nice features like receiving contactless payments using nothing but your iPhone via Tap to Pay.

bunq

bunq is a Dutch digital bank offering innovative features like multi-currency accounts, eco-friendly perks, and one of Europe’s highest savings interest rates. With a full banking license and deposit protection up to €100,000, bunq combines flexibility for travelers and expats with robust security and modern mobile banking apps.

General Information

- Deposit ProtectionUp to €100'000

- Customer SupportChat, email

- CurrenciesEUR, USD, GBP + 19

Bank Accounts

- Individuals Free plan available

- Businesses Free plan available

- Joint

- Convenience & User-friendliness

- Customer Support

- Features Available

- Value for Money

- Overall Rating

Anytime

Looking for something equally French? Anytime for businesses and professionals might just be up your alley. It can also be considered a "middle ground" between traditional and mobile-first banking, but unlike Qonto, it's leaning more towards the former.

Anytime

Anytime acts as a modernized version of a traditional bank and aims to become a top pick for both professional or personal banking purposes. Great for freelancers who want their funds consolidated, but conveniently divided into business and personal funds.

General Information

- Deposit ProtectionUp to €85'000

- Customer SupportPhone, chat, email

- CurrenciesEUR

Bank Accounts

- Individuals

- Businesses Starting at €9.5

- Joint

- Convenience & User-friendliness

- Customer Support

- Features Available

- Value for Money

- Overall Rating

Verdict: Qonto - solid choice for business banking?

Qonto is best described as a top-notch digital bank that is unequivocally French. What does that mean? Well, despite the last few decades where digitalization worldwide pushed for impersonal, fully online text-based communication, business in France made an impressive effort to resist that. Deals just won't happen without some chit-chat, a few smiles and handshakes here and there. Thus, as the whole world embraced banks' post-COVID efforts to make sure they never need to see you at their branch, French people actually don't seem to mind the chore of going to a bank every month.

On top of this, business banking just wouldn't feel right to a French entrepreneur unless it comes with an absurd amount of paperwork and interactions with notaries, consultants, account managers and other clerks. The amount of manual effort going into this is then used to justify ridiculous fees banks impose on customers.

Surprisingly though, neobanking behemoths like Revolut had a very hard time taking off, despite being way cheaper and ten times more convenient. Which is why the real USP of Qonto is being a "half/half" option for people tired of traditional banks because of how slow they are or how they lack flexibility, but not yet ready to dive deep into mobile-only banking world.

All in all, Qonto might be a great choice in a few cases: if your business has very specific banking needs and wants their bank to be as flexible as possible; if you strongly prefer having a dedicated account manager you can always reach out to; or in case you need to deal with cheque payments (something other digital-first banks rarely get involved with).

Either way, it feels like Qonto found their niche - its audience sits somewhere between two extremes: "Macbook and hoodie" millennial tech entrepreneurs and old-school "pen and paper" businessmen resisting the digital revolution. Do you fit in?