Review: Anytime (Expense Management & Pro Account)

Bank accounts for company creators, self-employed, startups & SMEs

Anytime for Professionals: General Information

In the rapidly evolving financial landscape, Anytime is emerging as a game-changer for businesses, expats, companies, and associations seeking a banking solution that marries the reliability of traditional banks with the agility and innovation of neobanks. Based in Belgium and France, Orange Bank's Anytime is crafting a unique niche in the market by offering a blend of services that cater to the diverse needs of its clientele.

With a starting price of as low as €9.50 per month and an option to get an account with no binding commitment, Anytime is making professional banking accessible to all, without compromising on the quality or breadth of its services. What sets Anytime apart is its commitment to providing a tailor-made expense management solution that can be defined in mere minutes, promising a level of customization and efficiency that is rare in the banking world.

This critical assessment of Anytime will delve into how this up-and-coming neobank is redefining business banking by offering a comprehensive package that aims to meet the nuanced needs of modern businesses and professionals in an increasingly globalized economy. We will provide general information first, then explore and compare plans offered, followed by pros & cons of Anytime and an FAQ before wrapping up with a concise summary.

Anytime: Key Facts

| Founded | 2014 |

|---|---|

| Headquarters | Brussels, BE |

| Customers | Undisclosed |

| Website | anyti.me |

| Personal Banking | ❌ |

| Business Banking | From €9.50 p/m |

| Sign-up Bonus | 30 days free trial |

| Web Client | ✔️ |

Anytime is designed to replace your current bank account or be used alongside an existing one. Anytime, a regulated financial services provider, is an Orange Bank company and holds licenses with the ACPR (Bank of France) and the FCA (Bank of England). With increased interest around this up-and-coming bank, we felt like it's worth taking a closer look.

In this review, our goal is to determine if Anytime's offering holds up in the highly competitive business banking space - read this review to find out how it compares to what's offered by competitors. This review is focused around the specific needs of freelancers, self-employed professionals and micro-businesses, however we will keep track of the offer's viability for SMEs, too. Without further ado, let's begin.

Anytime: Availability per country

Legal business entities registered in the following countries can sign up for a Anytime bank account for businesses:

Austria

Belgium

France

Germany

Ireland

Italy

Netherlands

Portugal

Spain

UK

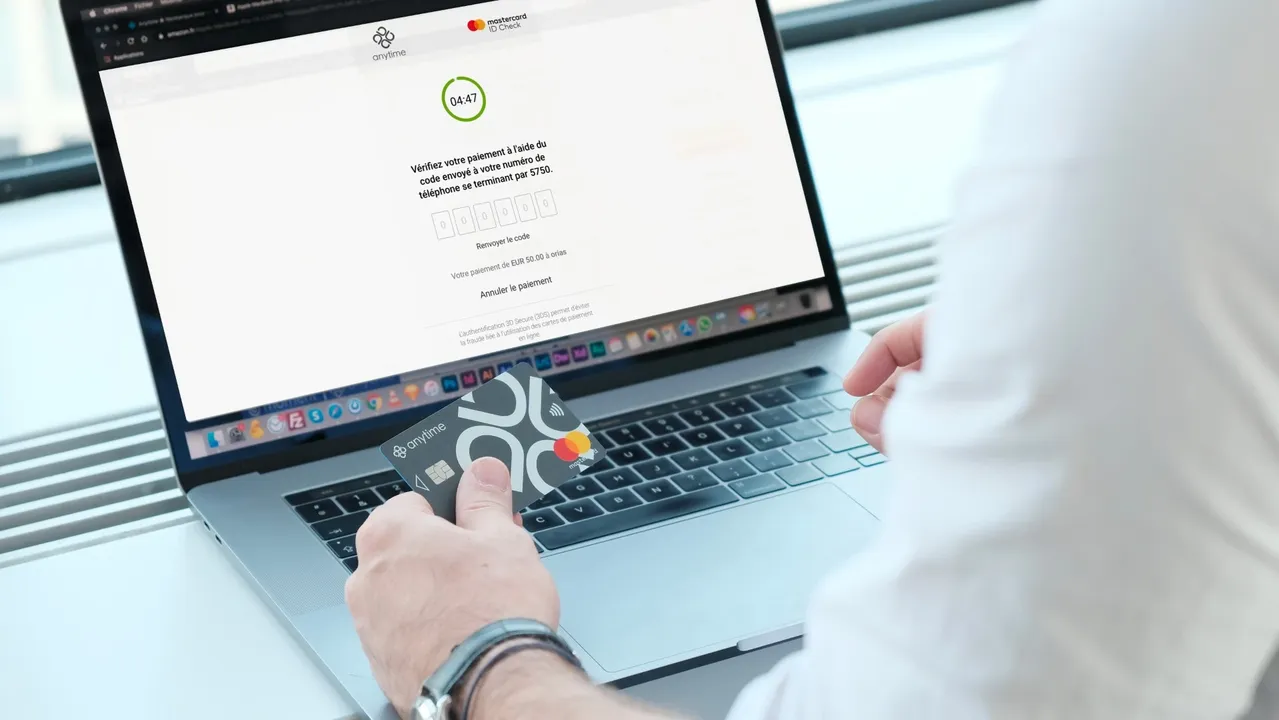

Anytime has stylish Mastercard debit cards available to all customers.

Business Bank Account Types at Anytime

Choosing the right business banking solution is crucial for freelancers, entrepreneurs, and SMEs aiming to streamline their financial operations and focus on growth. Anytime offers a range of banking plans designed to cater to the varying needs of modern businesses, from basic transactional capabilities to advanced financial management tools. Each plan, starting from Anytime START to EASY, and up to the BOOST option, is tailored to support businesses at different stages of their journey, ensuring there's a perfect fit for every type of enterprise.

All plans share a set of basic features like an account with a French IBAN, Mastercard Classic card, real-time transaction notifications and expert advisors in-app. This is supplemented by scalable benefits across plans. In this section, we'll delve into the specifics of each plan to help you determine which one aligns best with your business needs.

Note: Monthly fees indicated assume annual billing (giving -30% discount) and do not include VAT.

Anytime START

€9,50 p/m + VAT

The Anytime START plan offers a practical solution for freelancers and self-employed professionals to manage their finances with ease. It includes a 30-day trial for new users, a professional and a personal Mastercard, and up to 20 monthly transfers and direct debits. A notable addition is a free payment terminal, enhancing transaction capabilities.

START customers benefit from instant chat access to expert advisors and a solo legal protection package for comprehensive support. This plan is an affordable gateway to simplified business banking, complete with essential tools for efficient financial management.

Anytime EASY

€19,50 p/m + VAT

EASY enhances the benefits of START for streamlined expense management. It offers phone support in addition to chat, a Silver Mastercard Professional with higher limits, and increases free SEPA transfers and direct debits allowance to 100 per month.

Note: Make sure to read more aboutbenefits offered by Mastercard in our article on hidden upsides of purchasing things with your bank card!

Additional features include an integrated billing and quotation tool for faster payments and cash flow monitoring, enhanced insurance for added security, and a premium legal protection package. Ideal for businesses needing advanced financial tools and support, EASY plan makes managing expenses and operations smoother.

Bank Accounts for Businesses

Time is money if you're a business owner, franchisee or a freelancer. Discover modern mobile-first bank accounts for companies of any scale and explore unique features and products built for digital-native business owners.

Anytime BOOST

€29,50 p/m + VAT

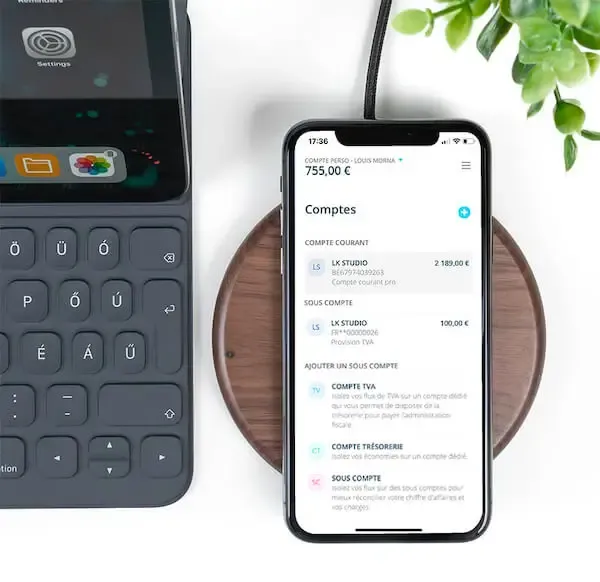

BOOST is the "all-in" option that expands on the mid-tier EASY plan's features. It's best suited for businesses requiring advanced financial management. This plan includes all EASY benefits plus four additional Silver Mastercard Professional cards, elevating its utility for teams. With an increased allowance for 200 free SEPA transfers and direct debits and five extra sub-accounts with dedicated IBANs (or "RIB" if you're French), it significantly enhances cash flow management.

The plan also introduces multi-company accounts, an invoicing and accounting export tool for streamlined financial operations, and maximum insurance coverage for comprehensive protection. Additionally, team access for up to five people, like accountants and partners, facilitates collaborative financial management, making BOOST ideal for growing businesses seeking efficiency and scalability.

You'll find a comparison table putting the plans offered side-by-side below. Important note: since all plans come with a "no strings attached" 30 days free trial, there's little to no reason to not give Anytime a try (if you think it satisfies your business banking needs, of course!).

Anytime: Plan Comparison Table (Business)

| Feature | Start | Easy | Boost |

|---|---|---|---|

| Price, per month | € 9.50 | € 19.50 | € 29.50 |

| Commitment | Cancel monthly | Cancel monthly | Cancel monthly |

| Sign-up bonus | 30 days free trial | ||

| Website | anyti.me | ||

| Accounts | |||

| IBANs | FR, BE | FR, BE | FR, BE |

| Sub-accounts included | 2 | 3 | 6 |

| Shared Access | ❌ | Business partner access | Business partner access |

| Employee Accounts | ✔️ | ✔️ | ✔️ |

| Mobile Payments | |||

| Apple Pay | ❌ | ❌ | ❌ |

| Google Pay | ❌ | ❌ | ❌ |

| Samsung Pay | ❌ | ❌ | ❌ |

| Other methods | - | - | - |

| Cards | |||

| Cards available | Mastercard | Mastercard | Mastercard |

| Cards included | 2 | 3 | 2 |

| Maestro/VPay | ❌ | ❌ | ❌ |

| Debit cards | ✔️ | ✔️ | ✔️ |

| Credit cards | ❌ | ❌ | ❌ |

| Virtual cards | ✔️ | ✔️ | ✔️ |

| Extra card fee | € 1.00 p/m | € 5.00 p/m | € 5.00 p/m |

| Replacement fee | € 14.90 | € 14.90 | € 14.90 |

| Free replacements | - | - | - |

| Metal card | ❌ | ❌ | ❌ |

| Wooden cards | ❌ | ❌ | ❌ |

| Payment Methods | |||

| iDeal | ❌ | ❌ | ❌ |

| SOFORT | ❌ | ❌ | ❌ |

| Bancontact | ❌ | ❌ | ❌ |

| Various Fees | |||

| SWIFT (receive) | € 3.00 | € 3.00 | € 3.00 |

| Foreign exchange fee | 1.80% | 1.80% | 1.80% |

| Currency fee-free limit | - | - | - |

| ATM Withdrawals | |||

| Daily limit | € 1,000 | € 2,000 | € 3,000 |

| Free withdrawals, per month | - | - | - |

| After that, per withdrawal | € 1.50 | € 1.20 | € 1.50 |

| Withdrawal fee abroad | € 1.90 + 1.8% | € 1.90 + 1.8% | € 1.90 + 1.8% |

| Interest Rate | |||

| Current accounts | ❌ | ❌ | ❌ |

| Savings accounts | ❌ | ❌ | ❌ |

| Transaction & Deposit Limits | |||

| Deposit limit | - | - | - |

| Deposit Protection | Up to €85'000 | ||

| Monthly spend limit | € 20,000 | € 60,000 | € 60,000 |

| Other financial products | |||

| Overdraft | ❌ | ❌ | ❌ |

| Investments in-app | ❌ | ❌ | ❌ |

| Crypto trading | ❌ | ❌ | ❌ |

| Cheques | €2 per cheque | €2 per cheque | €2 per cheque |

| Cashback | ❌ | ❌ | ❌ |

| Insurance | ❌ | Basic package | Enhanced package |

| Lounge access | ❌ | ❌ | ❌ |

| Transaction categorization | ✔️ | ✔️ | ✔️ |

| Purchase protection | €3'000 per year limit | €3'000 per year limit | €3'000 per year limit |

| Round-up savings | ❌ | ❌ | ❌ |

| Cash Flow Control | ✔️ | ✔️ | ✔️ |

| Deals & Discounts | ❌ | ❌ | ❌ |

| Other benefits | Legal hotline | Expense management | 300 virtual cards |

| Learn more |

Go to anyti.me

| ||

Looking to compare the best business banking offers available today? Anytime's bank accounts for companies are also featured in our selection of in-depth "one-on-one" comparisons. Find the list of comparisons of Anytime bank accounts by going to the links below:

Anytime: Pros & Cons

Advantages

To help you navigate the strengths of choosing Anytime for your business banking needs, we've compiled a list of key advantages. These benefits are designed to enhance your financial management and support your business growth effectively.

- Flexibility: Choice between a BE or FR IBAN, an option to assist in FR company creation process and cheque and cash management options, Anytime is pretty loaded in "traditional" banking features!

- Convenient App UI: Anytime bank has a very thought-through and powerful mobile app compliments the desktop experience quite well.

- Secure: At Anytime, funds are protected by an account arrangement with Crédit Mutuel Arkea in France and Barclays in England.

- Not a typical "digital only" bank: Just like with Qonto, you're not left with a digital screen only, there's always an option to talk to an actual human being on the phone (on higher tier plans only)..

Downsides

While Anytime offers numerous benefits, it's important to consider potential drawbacks to ensure it aligns with your specific business requirements. Below, we outline some of the main disadvantages that could impact your decision-making process.

Price: Anytime might appear cheap for a French bank, but it's still way more expensive than other EU neobanks like Finom, bunq or Revolut.

Price: Anytime might appear cheap for a French bank, but it's still way more expensive than other EU neobanks like Finom, bunq or Revolut. Just 1 IBAN: It's often you'd want to separate your transaction based on cost centers for accounting purposes and out of sheer convenience.

Just 1 IBAN: It's often you'd want to separate your transaction based on cost centers for accounting purposes and out of sheer convenience. Poor Localization: Anytime was always a French-first bank, so if you prefer English, you might run into some flaws here and there when using the app or navigating the website.

Poor Localization: Anytime was always a French-first bank, so if you prefer English, you might run into some flaws here and there when using the app or navigating the website.

Frequently Asked Questions

Navigating the world of business banking often brings up numerous questions, especially when considering a complex French neobank like Anytime. In our FAQ section, we aim to address some of the most common inquiries to help you gain a clearer understanding of what's offered and how it can fit into your business operations.

Is Anytime a real bank? Are my funds secure there?

Yes, Anytime is as reliable, secure and trustworthy as one of the "big traditional" brick-and-mortar banks like BNP or Société Générale. It undergoes the same level of scrutiny, extensive and exhaustive audits and is subject to the same policies and compliance checks as their "old-school" competitors are. Treezor, a payment institution behind Anytime bank is registered with the ACPR (Banque de France).

The company is a certified payment services provider (PSP) and is registered with the necessary regulatory authorities: ACPR (№0846315003) and with the FCA (№902033). As an additional measure, FGDR guarantees that all customers of Anytime have full insurance and guarantees of up to €100,000 per person, so no matter what, your funds are secure.

How can I reach Anytime bank customer support?

You have three options: via chat in-app, by sending an email or by calling a dedicated support line. You can expect chat responses between 9am to 5pm Monday to Friday, while the telephone line is active from 8.30am to 7pm on weekdays and until 5pm on Saturdays. For email, in our experience, you usually receive a response the same day (outside of weekends).

Can I create a new company with Anytime?

Yes - Anytime offers three company creation "packs" to choose from. We've described them in this article above.

Suggested Alternatives

While Anytime offers a comprehensive suite of features for freelancers, entrepreneurs, and SMEs, it's essential to explore the market to ensure you find the banking solution that best fits your unique business needs. Here are three competing solutions that offer distinct advantages and could serve as viable alternatives to Anytime Bank:

Revolut Business

Revolut Business stands out for its strong focus on providing a digital-first banking experience. Known for its robust app interface, competitive foreign exchange rates, and versatile spending controls, Revolut Business is tailored for companies that operate globally. With features like multi-currency accounts, expense management, and advanced budgeting tools, it’s an excellent choice for businesses looking to manage international transactions efficiently.

Revolut

Europe's biggest neobank, Revolut is a pioneer of mobile-first banking. Offering a wide range of financial services and banking products, including (but not limited to!) trading stocks and crypto, Revolut is a safe option regardless of customer's country of residence.

General Information

- Deposit ProtectionUp to £85'000

- Customer SupportChat, email

- Currencies30+ currencies

Bank Accounts

- Individuals Free plan available

- Businesses Free plan available

- Joint

- Convenience & User-friendliness

- Customer Support

- Features Available

- Value for Money

- Overall Rating

Qonto

French business banking superstar Qonto is a popular choice for businesses seeking a modern and efficient banking solution. Offering tailored plans for freelancers, SMEs, and larger corporations, Qonto provides features such as multi-IBANs, expense management tools, and real-time notifications. With its user-friendly interface and seamless integration with accounting software, Qonto stands out as a robust alternative to Anytime for businesses of all sizes.

Qonto

Qonto is a French neobank for businesses that is equally suited for freelancers, micro-businesses, SMEs and startups. Diverse in its product portfolio and capable of satisfying business needs of any caliber, Qonto now offers a one-month free trial for new users.

General Information

- Deposit ProtectionUp to €100'000

- Customer SupportPhone, chat, email

- CurrenciesEUR

Bank Accounts

- Individuals

- Businesses Starting at €9.0

- Joint

- Convenience & User-friendliness

- Customer Support

- Features Available

- Value for Money

- Overall Rating

Finom

Finom

Finom offers digital banking with built-in invoicing and expense management solutions for freelancers, self-employed and entrepreneurs, SMEs and companies under registration.

General Information

- Deposit ProtectionUp to €100'000

- Customer SupportChat, Whatsapp, Email

- CurrenciesEUR

Bank Accounts

- Individuals

- Businesses Free plan available

- Joint

- Convenience & User-friendliness

- Customer Support

- Features Available

- Value for Money

- Overall Rating

Finom is an all-in-one financial solution tailored for freelancers, entrepreneurs, and small businesses. With its intuitive interface and comprehensive features, Finom offers everything from multi-currency accounts and invoicing tools to expense tracking and tax assistance. Moreover, Finom's transparent pricing and commitment to customer service make it a competitive alternative to Anytime for companies looking for simplicity and flexibility in their banking solutions.

Review: Trade Republic - Invest & Save (2024)

Trade Republic reviewed by digital finance experts. Explore the fees, compare with alternatives and discover all pros & cons in our detailed assessment.

Read more...Also consider bunq bank from the Netherlands: fully localised in 6 languages, French, German, Dutch and Spanish IBANs starting at below €10 per month (incl. VAT)!

Each of these alternatives offers unique features and benefits that could suit different business models and needs. Whether your priority is cost-effective international banking, a user-friendly digital experience, or specific financial management tools, the market provides several strong contenders worth considering alongside Anytime.

Anytime: Our Assessment

In assessing Anytime's place within the spectrum of business banking solutions, it's clear that it occupies a somewhat unique position. With a suite of offerings that may seem unconventional to some, Anytime combines traditional banking features, such as access to multiple expert advisors, with the flexibility of modern financial technology services. While there are indeed cheaper alternatives in the market, such as Qonto, Revolut Business, and Finom, which cater to a wide range of business banking needs with more competitive pricing structures, the value of Anytime shouldn't be dismissed outright.

For businesses that prioritize a traditional banking approach, complete with the personalized support of expert advisors and a suite of comprehensive banking tools, Anytime could very well be the right fit. The platform's emphasis on providing a blend of conventional and innovative banking services means it might align well with enterprises that value this mix.

Ultimately, the decision hinges on the specific and unique banking needs of your venture. Every business has its own set of priorities and requirements from a banking partner, and what works for one may not suit another. Anytime's offering, while distinct, could be exactly what some businesses are looking for. Given the 30-day free trial, there's little downside in experimenting with Anytime's services to see if they mesh well with your business operations. This trial period is an excellent opportunity to explore how Anytime's features and services can support your business goals without any initial financial commitment.