Review: Bitpanda Investment App

Learn more about trading stocks, buying crypto and metals with Bitpanda

General Information

Bitpanda is an "all-in-one" investment platform based in Vienna, Austria. This savings & investment app offers more than 200 cryptocurrencies, multiple crypto indices, stocks, ETFs, commodity trading and precious metals. Founded in 2014, Bitpanda became not only Austria's first fintech unicorn (a start-up company valued at over €1 Billion), but also one of the fastest growing fintech companies in Europe. Today, Bitpanda (formerly known as Coinimal) has over 3 million users and enjoys heaps of positive feedback from customers on review aggregators like Trustpilot (with an impressive average of 4,4 out of 5 stars).

To write this review, we had each of our three experts in finance, banking and financial technology open a Bitpanda account and spend a week with it hands-on, trading, trying out the Bitpanda card and all the Bitpanda app features. In this review, we present a summary of their feedback by presenting all pros and cons Bitpanda has, assessing key features and suggesting possible Bitpanda alternatives a retail investor or someone new to investing would appreciate. if the platform is a good choice for a retail investor and if it's able to compete with dozens of alternatives available today.

Bitpanda at a glance

| Founded | 2014 |

|---|---|

| HQ | Vienna, Austria |

| Users | >3'000'000 |

| Official Website | bitpanda.com |

| Crypto | 50+ coins |

| Stocks | Stocks & ETFs |

| Metals | 4 metals |

| Card | VISA Debit |

Timed exclusive for Fintech Compass readers: Get €5 in BEST for free!

Sign up for Bitpanda via any of the links in this review to claim it!

Our Bitpanda card got scratched quite fast, but the black finish looks great.

Next to its core offering, Bitpanda offers a variety of expert (Bitpanda Pro, a fully regulated and EU based crypto exchange with a powerful API), institutional and B2B (white label trading product) solutions. The platform is a great choice for a beginner starting out in the investment world thanks to its simplistic UI and an ability for users to engage in fractional investment (for example, buying just 20 euro worth of Tesla stock without committing to purchasing an entire share worth over $1'000). It can also be a convenient stepping stone for a "traditional" stock market investor to dip their feet in crypto trading (or vice versa), or a reliable platform to set up your long-term savings plan at exactly a risk level you're comfortable with.

⚠️ Warning! Investment is never without risk. You may lose your investment due to market risks involved. ⚠️

Investment products available

Bitpanda offers a wide range of options to invest your assets - we will review Bitpanda Stocks, their selection of stocks and ETF available, a selection of precious metals offered, and the core product Bitpanda started with back in 2014, cryptocurrency trading (including crypto indices). We will also dive deeper with a quick review of Bitpanda Visa debit card, an innovative solution that allows users to pay for purchases all over the world using your cryptocurrencies, stocks or fiat money.

Cryptocurrencies

200+ coins

"Join the crypto movement", claims Bitpanda's website. Bitcoin, Ethereum, Binance coin, Doge, Tether are available for trading 24/7 in addition to their own token called BEST, Bitpanda Ecosystem Token, that had an impressive run in the last 12 months, gaining over 1000% in price during that time frame. For a more risk-averse crypto investor, a selection of crypto indices is available - BCI index combines a selection of top 5/10/25 cryptocurrencies based on their market size for a more balanced portfolio.

New to the world of cryptocurrencies? Make sure to visit ourComplete Beginner's Guide to Crypto & Blockchain where our experts try to explain complex concepts in simple terms so you can absorb essential knowledge without feeling overwhelmed.

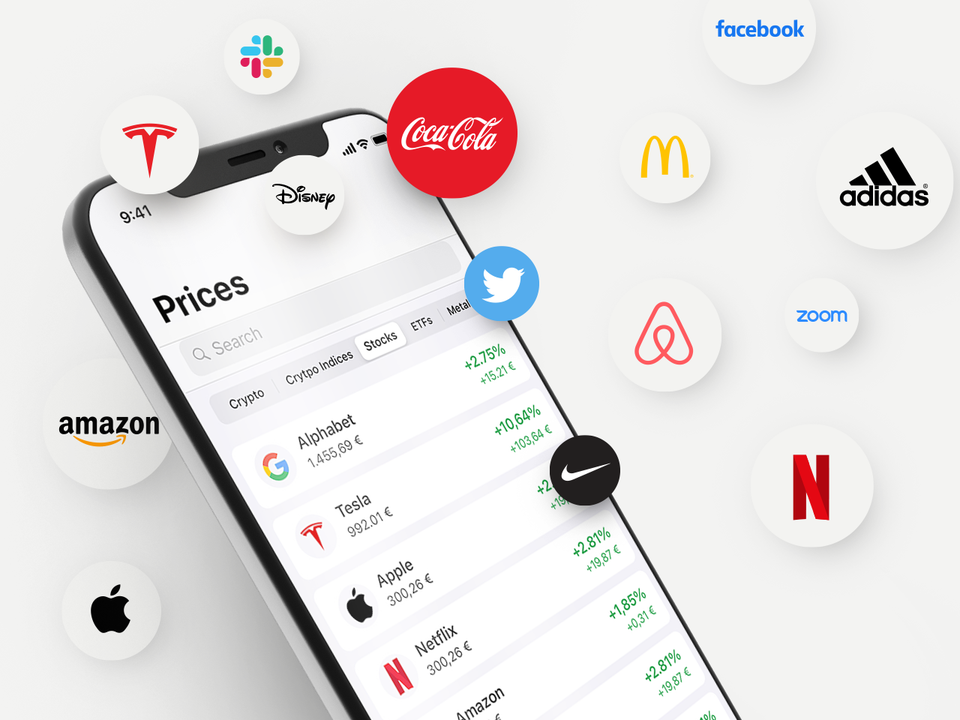

Stocks & ETFs

Available 24/7

Fractional investment starting at €1, available 24/7 and fully backed by physical assets held by a custody bank. Commission- and exchange rate fee-free, Bitpanda only profits on a "spread" between the "Buy" and "Sell" positions. The base platform is probably not going to be enough for an experienced investor looking to start day trading (if you're one of them, you should read about Bitpanda Pro - we explain what it is in a section below), but it's more than enough to give someone just looking to set up a simple portfolio of popular and up-and-coming stocks without overwhelming them with all the complex nuances. Investing in fractions of stocks also works great in conjunction with Bitpanda Savings plans (we'll get to them a bit later).

Note: Bitpanda Stocks are contracts replicating an underlying stock or ETF. What does it mean? While technically not a share (i.e. you will not get to attend a shareholder meeting), any investment you make is a purchase of a contract that is a direct replica of the stock you are trading. This was most likely done for legal reasons in order to make fractional trading (buying a fraction of a share, rather than an entire one) possible.

Metals

Gold, Silver, XPD, XPT

Buy certified, investment-grade precious metals: Gold, Silver, Palladium and Platinum. Those frequently act as a stable and secure way to diversify your investment portfolio and protect it against the risks of your more volatile investments. The metals you invest in at Bitpanda are investment-grade bullion and accredited by LBMA, and are your actual legal property that is stored in a high-security bullion market vault in Switzerland. Frequently overlooked by beginner investors due to low potential earnings in the short term, metals have their advantages: they tend to hold their values when other assets do not, thus acting as a stable safeguard of your portfolio against excess volatility. If your goal is long-term, it is frequently a good idea to diversify and strengthen your portfolio, and that is the niche precious metals tend to occupy (and do well in!) today.

Margin Trading

Lower fees!

A new feature that only became available on 18.04.2023. Bitpanda Leverage is a simple and very straightforward way to trade crypto with leverage. Available for just 10 positions currently, and only giving customers 2x margin (meaning, a 4% increase in, say, BTC price will net you 8% in return) it still is a valuable tool when used correctly. You can open both short (if you expect the price to go down in the future) and long positions, and it's a great financial instrument, however, it is important to note that this essentially doubles your risk exposure, so trade responsibly and be ready for the risks involved.

Bitpanda Card

Pay with crypto

Do you want to spend your investments like cash? Bitpanda offers a Visa card that allows users to pay directly from their investment portfolio - you make your payments using crypto, metal or other assets. The mobile app has everything you need to fully control the card: you can switch the asset you want to use for executing payments and set up a fallback "pocket" to draw from, check your monthly spending overviews and real-time transaction history. This is a Visa debit card, meaning it's accepted by over 54 million merchants in 200+ countries, just like any other Visa card. Additionally, BEST VIPs can further amplify their spending by earning BTC cashback of 0.5% to 2% per transaction (we will provide a detailed overview of BEST later on in this review). Bitpanda card also offers 3D Secure technology for additional transaction protection, and you can always block and unblock the card "on the fly" via mobile app.

The best part, however, is that the card is absolutely free and there are no monthly fees associated with owning or using this card. All Euro transactions are also free of charge. The only fees Bitpanda charges users for are ATM withdrawal fees and a slight fee applied to paying in foreign currency (rate varies per country). With terms like this, you might be wondering how the company makes money. The only revenue source for Bitpanda here are regular trading premiums applied when the asset chosen for payments is converted to Euros as you pay with your card. Tip: If you want to avoid trading premiums altogether, you can always link the card to your EUR wallet in Bitpanda's mobile app!

Does Bitpanda look like it might just be your platform of choice? Visit Bitpanda's website and download the mobile app to get a hands-on experience with the product used by over 3 million users worldwide. Thanks to no monthly or one-off fees, you can always try the platform before you commit to it. You would, however, need to spend a minute or two verifying your identity through the same third party service used by digital banks like Revolut. This requirement is in place due to EU-wide regulations and policies, but that should not discourage you - in fact, it's good news! Not only does is it a standard process for signing up to any platform and a very minor hurdle to overcome, but it's also a mechanism that ensures your assets and personal information are safe from scammers and fraudsters.

Unique Benefits of Bitpanda

Given a constantly growing amount of solutions available on the market today, an "all-in-one" investment product must go beyond the basics: low fees and premiums, good customer support and a convenient mobile app are just not enough to stand out. After all, you could say that, for instance, Trade Republic's savings and investment app ticks off all these boxes, right?

This "space race" ultimately benefits the end consumers - stiff competition forces companies to innovate and users get to enjoy unique features as platforms compete for consumers. Below, we will be taking a look at some unique products and features Bitpanda has to offer.

BEST - Bitpanda Ecosystem Token

BEST is Bitpanda's ecosystem token that runs on the Ethereum blockchain. The value of this token is maintained by the burn mechanism that ensures that the BEST supply becomes scarcer over time. BEST is frequently given to users as rewards - for example for completing Bitpanda Academy quiz or in form of a monthly reward deposited directly into your account based on your total transaction volume last month. The principle is simple: the more you trade and the more BEST you hold, the more you are entitled to earn. BEST grew in value significantly over the last few years as Bitpanda scaled up as a company, thus early investors got a sizeable return on their initial investment.

Multiply Your Wealth

Doesn't matter if you're just saving up for that summer vacation or if you're planning your retirement, the best time to start investing is now. Explore our curated list of the best investment platforms and apps available today at Fintech Compass. Make your money work so you don't have to.

Bitpanda Academy

Are there questions about cryptocurrencies or investments you are too afraid to ask? Do you want to get a better understanding of a blockchain? Or are you struggling with managing your finances efficiently? Perhaps you finally decided to find out what NFTs are? If your answer to any of these questions is "yes", then Bitpanda Academy might be what you're looking for! Similar to learning materials provided by Dutch neobroker BUX Zero, Bitpanda Academy aims to educate users on everything crypto and investments, in bite-sized pieces that are easy to digest.

Free €5 Reward: completing a simple quiz at Bitpanda Academy gets you €5 value of BEST (Bitpanda Ecosystem Tokens) in your account, completely for free!

Crypto Indices

Bitpanda Crypto Index (powered by MVIS) is a low-involvement crypto trading solution for retail investors who can not afford to constantly monitor the market and adjust their portfolio. In just one click, Bitpanda Crypto Index automatically invests in a diverse portfolio of the top 5, top 10 or top 25 cryptocurrencies on the market, based on total market cap and coin's liquidity. Since BCI automatically adjusts the share of each asset in your portfolio over time, you can be confident you will never miss out on “the next big thing". Bitpanda describes this product as a "hands-off approach to crypto investing", which is perfect for people who do not want to miss being part of the crypto revolution of last decade without investing too much time.

Savings plan

Have you been putting off setting up your personal savings plan? With Bitpanda, it's easy to build your personal portfolio for digital assets over time. Once you create a savings plan, it automatically buys assets on a schedule you set. You can then forget all about it while Bitpanda auto-invests your funds (you can use SEPA direct debits, Visa and MasterCard) so you can buy Bitcoin, Ethereum, gold and many more over a longer time period.

Bitpanda: Pros & Cons

Advantages

- All-in-one platform: research shows that 84% of digital finance app users prefer one-stop shop for all their personal finance. An app allowing you to invest in a wide range of assets, as well as pay using a Visa card is a great way to centralize your wealth.

- Great for an inexperienced investor: because it's so easy and does not overwhelm you with details you should learn at your own pace. If you want to accelerate that pace, there is always Bitpanda Academy to boost your expertise.

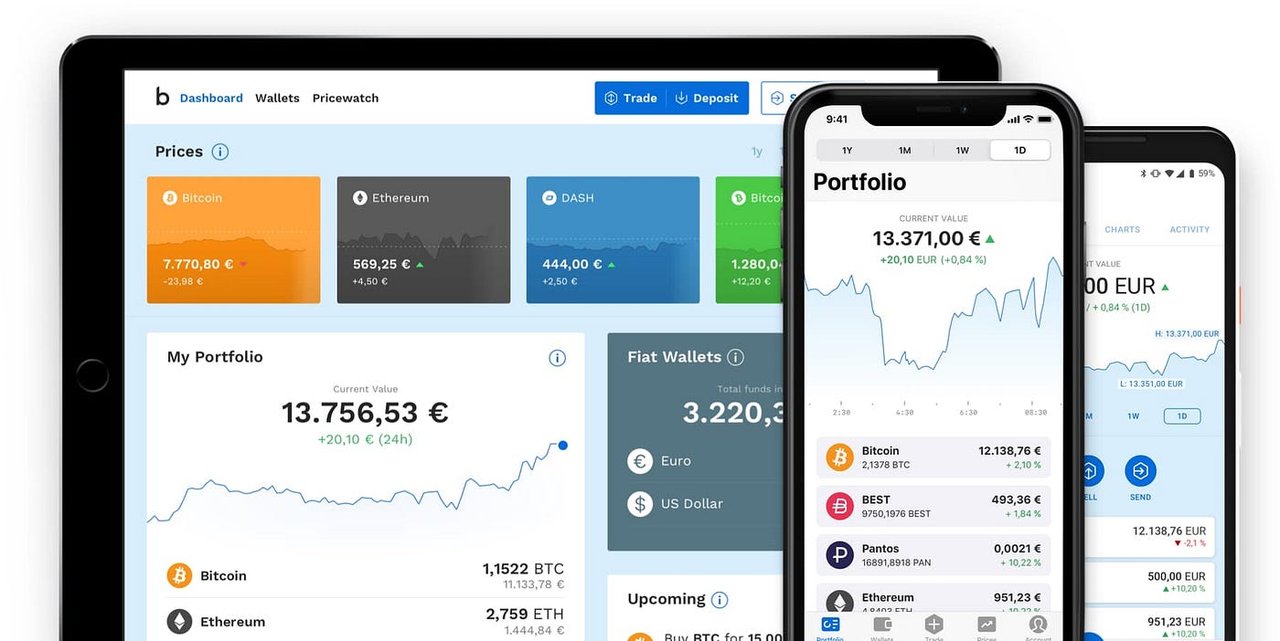

- Any device available: Bitpanda offers great iOS and Android apps, as well as a fully functional desktop in-browser experience.

- Safe & Secure: Bitpanda GmbH is a MiFID II investment firm that holds a PSD 2 payment institution license. It is fully compliant with AML5 with funds securely stored in offline wallets. The Austrian customer protection laws are among the most consumer-friendly in the whole world as well, so you can be confident your funds are safe there.

Downsides

Limited stock & ETF selection: granted, it is constantly expanding, but sometimes you might not find certain up-and-coming stocks available on the platform. However, the most popular options among retail investors are all represented, so that might not be a downside for you.

Limited stock & ETF selection: granted, it is constantly expanding, but sometimes you might not find certain up-and-coming stocks available on the platform. However, the most popular options among retail investors are all represented, so that might not be a downside for you. Lack of transparency: Bitpanda repeatedly claims that the trades are all commission-free without any fees applied, and you only get charged the "spread". However, the math behind the spread possible is not available anywhere, which makes the platform less transparent.

Lack of transparency: Bitpanda repeatedly claims that the trades are all commission-free without any fees applied, and you only get charged the "spread". However, the math behind the spread possible is not available anywhere, which makes the platform less transparent. Account deposit options: depending on where you're from, you might have trouble depositing money into your account. The standard options are there, of course and you can always use a SEPA bank transfer or deposit funds using MasterCard or Visa.

Account deposit options: depending on where you're from, you might have trouble depositing money into your account. The standard options are there, of course and you can always use a SEPA bank transfer or deposit funds using MasterCard or Visa.

Frequently Asked Questions

How do I contact Bitpanda?

You can reach out to Bitpanda's customer support at support@bitpanda.com or by visiting Bitpanda helpdesk. Of course, you can always message support from within the Bitpanda app as well.

Is Bitpanda secure, reliable and trustworthy?

The Austrian company, Bitpanda GmbH, is a MiFID II investment firm and a PSD 2 licensed payment institution. The investment product is fully AML5 compliant, so you do not have to worry about the safety of your funds or transactions.

What is Pantos (PAN)?

Pantos is the first multi-blockchain token system and a scientific project by the team behind Bitpanda's growth. Its R&D process is performed in close collaboration with Technical University of Vienna. The goal of Pantos is to bring blockchain projects closer together, improve communication between blockchain devs, researchers and end users, as well as to set innovative standards for cross-chain token transfers.

Bitpanda Alternatives

We asked our experts for suggestions to consider when choosing an "all-in one" savings and investment app, neobroker or a multi-asset trading platform. Here are some options to consider if you're intrigued by Bitpanda:

Both BUX & Trade Republic (two European neobrokers with very similar products we've compared before) are very solid options if you're looking for an easy to use and very straightforward app to help you make your money work without going into too much detail.

Trade Republic

A fully-regulated German investment platform for trading stocks, ETFs, cryptocurrencies, Trade Republic is an up-and-coming financial institution with a very easy-to-use product aimed at people looking to make first steps on their investment journey.

Active Promotion for FC Visitors: Up to €500 bonus on your deposit!

- Convenience & User-friendliness

- Customer Support

- Features Available

- Trading Fees

- Asset Selection

- Overall Rating

BUX Zero

Founded in 2014 and publicly launched in 2019, BUX quickly got an impressive following by providing users a very convenient, jargon-free and transparent product. BUX Zero is available in 8 countries in Europe and boasts very low (zero in some cases!) transaction fees.

- Convenience & User-friendliness

- Customer Support

- Features Available

- Trading Fees

- Asset Selection

- Overall Rating

If you're into DACH fintechs and like paying with cryptocurrencies, consider Vivid Money. A payment card with a proper bank account and access to crypto - all in the same app. What's not to like? In a similar vein, Wirex might be if you're looking to invest, stake and hold crypto on mobile.

Vivid

Vivid is an up-and-coming financial "one-stop-shop" app: payments and transfers, an interest on your current account, 3000+ ETFs & stocks from companies all over the world along with 50+ cryptocurrencies on top of and an ability to store funds in over 40 currencies.

- Convenience & User-friendliness

- Customer Support

- Features Available

- Trading Fees

- Asset Selection

- Overall Rating

Wirex

Wirex is a simple-to-use platform offering cryptocurrency trading, cashback on purchases in crypto and no fees on fiat currency exchange on top. Wirex also offers very impressive annual return on various assets in a "hassle-free" fashion.

- Convenience & User-friendliness

- Customer Support

- Features Available

- Trading Fees

- Asset Selection

- Overall Rating

Our verdict: Is Bitpanda a good choice for a retail investor?

In short: yes, it is. Bitpanda is a very solid choice if you are looking for an easy to grasp, yet powerful investment tool with a wide range of assets to choose from. However, an experienced investor managing a significant portoflio might find themselves lacking some of the more complex features other platforms might provide. With the Austrian fintech superstar growing rapidly the last few years, it might be fair to assume that the range of products, coins and stocks available would also expand in the coming years. This outcome is great news for anyone trading on Bitpanda as the loyalty rewards and cashback accumulating in BEST (Bitpanda Ecosystem Tokens) would only accelerate your portfolio's growth.

Mobile apps on both iOS and Android work well, have no unnecessary features and are visually appealing as well. Desktop browser client's feature set is somewhat limited, but the UI is very clean and all the core functions you would expect to be there are present and work flawlessly. Bitpanda also enjoys a great customer rating with an average of 4,4 stars out of 5 on Trustpilot (and while at it, please help us get better by leaving Fintech Compass a review too!).

As an extra side bonus, your stylish black Bitpanda Visa card is bound to catch some looks, and you can always tell your friends that the next round is not only on you, but will also be paid for with Bitcoin or Ethereum. It is not exactly a mainstream feature yet, so you can bet that would make an impression.

Eager to start your new investment journey? Follow the links below and tell us what you think afterwards! We are always happy to hear your feedback, so we can provide our readers with more exhaustive and accurate information every day.

⚠️ Warning! Investment is never without risk. You may lose your investment due to market risks involved. ⚠️