Trade Republic: Review (2024 Update)

Pros & Cons, Fees, Alternatives and Comparisons

General Information

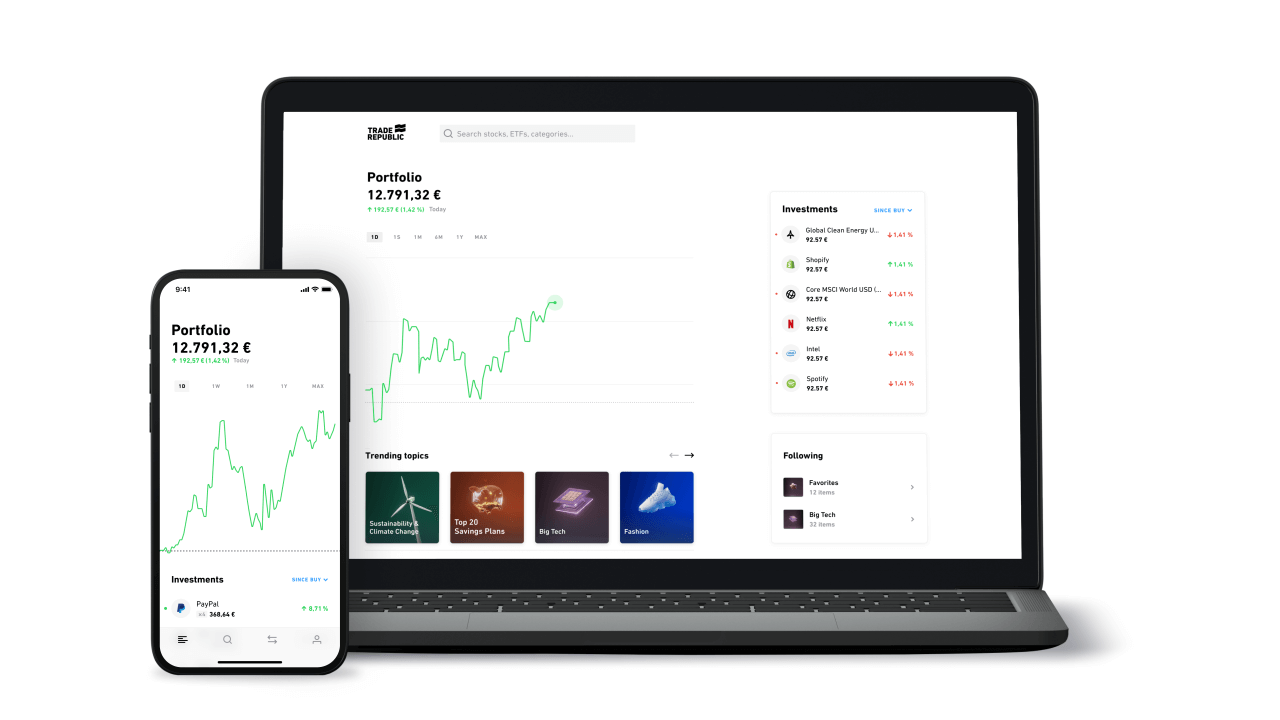

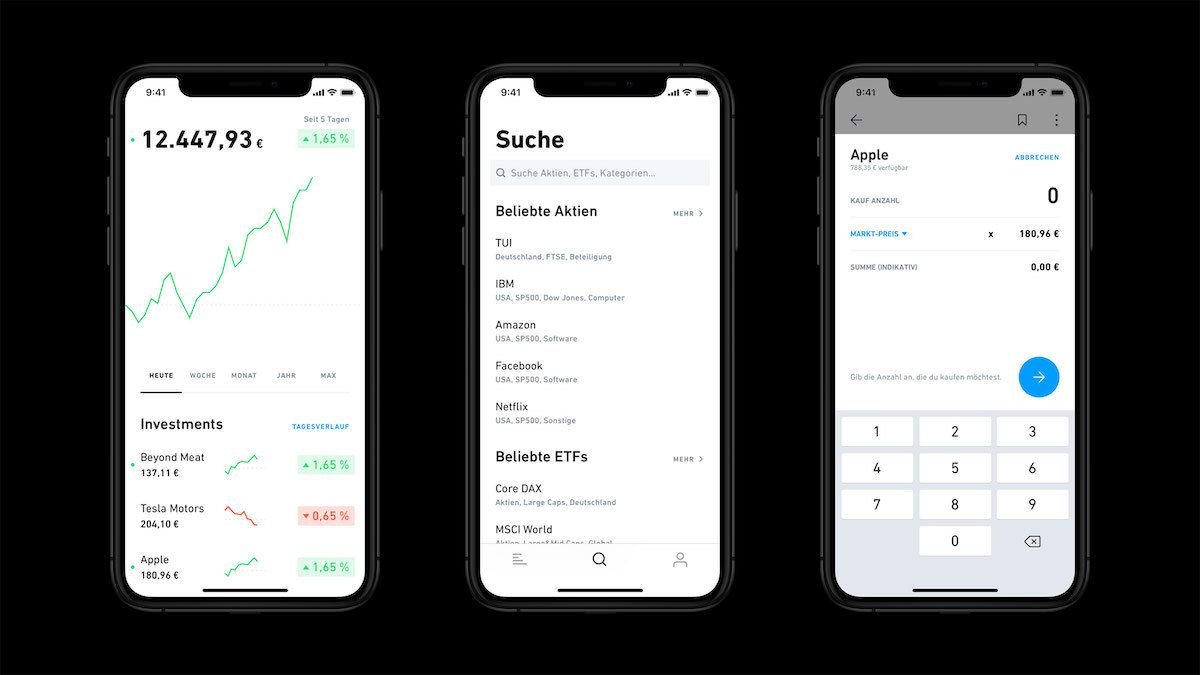

Trade Republic is an investment platform with a goal of making investments easy. Trade Republic gives new and experienced retail investors extreme convenience when trade a variety of assets, including stocks & ETFs, cryptocurrencies and derivatives. Founded in 2015 through a startup incubator, Trade Republic is based on Germany and is available in 16 other European markets including Austria, France, Italy, Netherlands and Spain.

What made the German savings app explode in popularity? The company has captivated the attention of savers and investors alike by offering a massive 4% interest rate on user deposits, a figure that starkly outpaces traditional banking options and places it at the forefront of the industry's most generous offerings. Adding to its allure, Trade Republic recently unveiled its own bank card, ingeniously designed to blend everyday spending with saving incentives. This card offers an attractive 1% cashback on purchases, seamlessly integrating the concept of earning while spending, all at no monthly cost to the user.

Similar to other investment platforms, such as the "all-in-one" investments app BUX (which we previously compared to Trade Republic side-by-side), Trade Republic maintains a very clear and transparent fee structure for using its services. It is available through both iOS and Android apps as well as in your web browser.

Trade Republic at a glance

| Founded | 2015 |

|---|---|

| HQ | Munich, DE |

| Users | > 4'000'000 |

| Official Website | traderepublic.com |

| Crypto | 50+ coins |

| Stocks | Over 8000 stocks |

| Metals | Not available |

| Card | Coming soon! |

Timed exclusive for Fintech Compass readers: Up to €500 bonus on your deposit!

Sign up for Trade Republic via any of the links in this review to claim it!

Despite being one of the youngest investment apps on the market, Trade Republic quickly hit a milestone of over 1 million customers and managed to quadruple that number in just two years, reaching a milestone of 4 million users by early 2024. That is an impressive milestone as the platform was only operating in a handful of European markets until the rapid expansion all over Europe recently.

The company also claims that about one third of its users had never invested in stocks or ETFs prior to finding their way the platform, which is a solid testimony to the beginner-friendliness of its applications. One of the rarer investment products available at Trade Republic is derivatives, it’s a relatively advanced asset you don’t typically find in an "all-in-one" investment apps.

To prepare this detailed review, we had 3 digital finance and banking professionals download Trade Republic app, spend a week using it extensively and provide us with their expert assessment of the platform. In this article, we present a summary of their most important critique and all the crucial information about Trade Republic you need to know. Our goal here is to inform an average retail investor well enough so you are comfortable deciding whether Trade Republic is a platform that fits your unique needs and circumstances.

UPDATE: As of 01.02.2024, the German platform now offers an additional benefit to all users: all Trade Republic customers now receive 4% annual interest rate on all cash balances of up to €50'000, paid out monthly.

But before we begin, we invite you to explore our selection of content created to help both beginner investors and seasoned traders:

⚠️ Warning! Investment is never without risk. You may lose your investment due to market risks involved. ⚠️

Trade Republic: Investment Products Available

It is no surprise that you will find all of the most common and popular asset types on Trade Republic. In addition to classic stocks & ETFs, you can buy, sell and store cryptocurrencies and invest in derivatives to further diversify your portfolio. In this section we’ll dive into some specifics on each of the investment products Trade Republic offers, including their availability, fees and key information to keep in mind.

Stocks and ETFs

10'000+ Available

Taking it one level beyond competitors like the famous Dutch investment app BUX, Trade Republic offers a wide selection of global stocks & ETFs beyond Europe & US, giving customers easy access to stocks such as Nintendo. The standard options of buying and selling securities are available with market order (executed at the best available price), limit order (executed at or higher a predetermined price) and stop order (executed at a predetermined lower price). Trade Republic charges no variable fees on orders, however there’s a €1 charge to cover settlement per trade, unless you make an order through the Savings Plan (more on that feature below), which is free of charge. Surprisingly, it is also possible to place an order by post, which comes with a hefty €25 fee per order execution.

An additional benefit is an ability to buy fractional shares, meaning you do not have to commit to purchasing a whole share of your choice. This is great as some shares can cost over €1000 each, and having an ability to only purchase €10 worth of this stock allows for greater flexibility when assembling your portfolio.

Review: Vivid - Mobile Banking, Investments & Crypto

Vivid Money reviewed by fintech experts. Pros and cons, key info and all hidden costs. Discover Vivid's features and compare it with the best competitors.

Read more...Cryptocurrencies

50+ coins

Trade Republic has over 50 cryptocurrencies available for purchase. Similar to stock & ETF orders, crypto trades are commission-free with a flat €1 fee on single orders to cover settlement costs. Buying Bitcoin, Ethereum, XRP and many more can be done 24/7 and your trades (which can be as small in value as €1!) are protected as the platform is regulated by German financial authorities. An additional benefit is that crypto you hold with Trade Republic are stored in a cold wallet storage offline. Granted, the selection of coins and tokens available is not exactly impressive if you compare it with "crypto-first" specialized exchanges like the social crypto trading powerhouse eToro or the wildly popular US-based Gemini crypto exchange. However, the added convenience and simplicity combined with very low fees make Trade Republic an excellent choice for anyone who is not a professional trader.

Confused about the crypto terminology? Check out our "Beginner's Guide to Crypto & Blockchain" to learn more!

NOTE: Cryptocurrency trading via Trade Republic is currently only available in Germany, Spain and Italy.

Derivatives

Premium partners

Thanks to Trade Republic partnering with Société Générale, CITI and HSBC, you can access countless warrants, knock-outs and factor certificates through Trade Republic on European and US companies. This is a relatively advanced investment product for general retail investor population, we recommend to go through some resources first and experiment with orders of small amounts. The fee schedule for orders is consistent with other assets - zero commission on all orders and a flat €1 fee per trade to cover Trade Republic's costs.

NOTE: Derivatives trading is currently only available in Belgium, Germany, Spain, France, Italy, Austria, Portugal and Finland.

Trade Republic: Fees & Other Costs

One of the biggest benefits of Trade Republic is a straightforward and transparent fee structure with reasonably low trading fees. In fact, there is no variable commission for executing trades - only a flat €1 fee per trade to cover the platforms' costs for processing users' payments. Below you will find a table listing all Trade Republic usage fees and other costs applicable (excluding fees for custodial account services provided to corporations and financial institutions).

Please note: Fintech Compass is committed to keeping pricing information up-to-date at all times, however we still advise exploring theplatform's official website or information in the mobile apps in case of unexpected changes.

| Applicable fees | |

|---|---|

| Trading fees - Stocks & ETFs | - |

| Trading fees - Cryptocurrencies | - |

| Settlement fee, per trade | €1,00 (regardless of trade amount) |

| Settlement fee for Savings Plans: Buy | - |

| Settlement fee for Savings Plans: Sell | €1,00 fixed fee for selling your assets |

| Orders placed by post, per order | €25,00 |

| Deposit via SEPA transfer: First deposit | €0 |

| Deposit via SEPA transfer: Subsequent deposits | 0,7% of deposit amount |

Unique Benefits: Trade Republic

With an abundance of innovative and powerful investment platforms and apps available today, consumers are right to expect something extra. Below, we will go over the features and benefits that set Trade Republic apart from competing savings and investment platforms.

Savings Plans

Trade Republic Savings Plan feature gives users an ability to set up recurring purchases of any investment products. Creating a "fire and forget" holiday or retirement fund for yourself is extremely simple. Just choose how frequently you want to invest, which specific assets you want to buy and put in a desired amount for each share or coin. The best part, however, is that purchasing assets as part of your Trading Plan comes at no cost at all!

Want to buy €100 of Bitcoin and €100 of Apple stock every time your salary hits the bank account? With Trade Republic, setting this up for years to come only takes a minute or two. And you can, of course, stop your plan at any time. This feature is more-or-less an exact replica of Bitpanda "all-in-one" investment platform's savings plan feature (and yes, they both have the exact same name).

Invest with Trending Topics

Want to invest in cutting-edge Web3 companies or a specific industry but do not have the time required to always be up-to-date on the best performers and all the news in that space? With "Trending Topics", it's easy to invest in certain industries or business types, for example, Metaverse startups or sustainability-first companies. That way, you make use of professional traders' expertise without any hassle or time investment on your side.

To explore the selection of topics available, open the app and navigate to the "Order Manager" tab. You can find an overview of all active Savings Plans and when the next time they executed are. Worth noting: your pending limit and stop orders are also listed here.

Selection of Investment Products Available

For most retail investors, the biggest benefit of Trade Republic is the wide range of investment products you can have in your portfolio, all in one app. A truly rich selection of assets is available for trading: over 50 cryptocurrencies, more than 10'000 stocks and ETFs, plus derivatives to top it off. This means you can sufficiently diversify your portfolio using various instruments traded on different markets and exchanges, all in one app at a very low cost.

Security & Protection Features

Security is undoubtedly the №1 concern when it comes to storing your money at any third party. Trade Republic is a fully licensed German financial institution that is supervised by the Federal Bank of Germany and BaFin (Federal Financial Supervisory Authority). This means that all customer deposits held by Trade Republic are subject to Deposits Protection Scheme for an amount of up to €100,000 and the company undergoes regular financial, security and operations audits by the regulators.

The platform also stores your crypto in a cold wallet offline, which is the most secure method of storing crypto. This makes Trade Republic as reliable as world's most reputable stock brokers like DEGIRO or the biggest and most reputable cryptocurrency exchanges with industry-leading security like the US-based Kraken Digital Assets.

Trade Republic branded card

Coming soon! You can sign up for the Trade Republic bank card waitlist by following this link. What we know already is:

- It's a stylish glossy metal card (not clear if Visa or Mastercard yet)

- Users get 1% cashback on purchases made using their TR card

- Your account balance automatically gets 4% interest rate, paid out monthly

We will make sure to update this review once the team behind this article gets their shiny new card. Meanwhile, it's worth taking a look at other great metal cards available in Europe today!

Multiply Your Wealth

Doesn't matter if you're just saving up for that summer vacation or if you're planning your retirement, the best time to start investing is now. Explore our curated list of the best investment platforms and apps available today at Fintech Compass. Make your money work so you don't have to.

Trade Republic: Pros & Cons

Advantages

Summarizing the key benefits of Trade Republic, we wanted to highlight the following points. These make Trade Republic a very solid choice for most, if not all, retail investors looking to start their investments journey.

- Investment product options: Trade Republic offers one of the most extensive range of investment products in terms of both width and depth, among the new investment apps started within the last five to ten years.

- Security: Trade republic ticks all the important boxes when it comes to security. Being a Germany-based investment platform that’s well regulated, customers can trust that the platform has solid security processes to safeguard their funds.

- Simple and transparent fees: This is worth highlighting even though many platforms are doing it quite well. With Trade Republic the baseline fee structure is exactly the same across all investment products, avoiding a lot of confusion and surprises for the customers.

Downsides

We mentioned a variety of positive aspects of Trade Republic in this review already, but there are a couple of shortcomings and cons you should be aware of.

Regional availability: overall Trade Republic offers a great selection of investment products, however there are only a handful of markets where you can access all products. Make sure to double check what’s available in your country.

Regional availability: overall Trade Republic offers a great selection of investment products, however there are only a handful of markets where you can access all products. Make sure to double check what’s available in your country. Lack of educational resources for beginners: not a ton of resources are available from Trade Republic to help beginners get up to speed and dip their toes in the investment world.

Lack of educational resources for beginners: not a ton of resources are available from Trade Republic to help beginners get up to speed and dip their toes in the investment world. €1 single order fee: the order fee is fairly reasonable and low. As the cost does not depend on the order value, it would feel significant in case your trade's total value is just €5.

€1 single order fee: the order fee is fairly reasonable and low. As the cost does not depend on the order value, it would feel significant in case your trade's total value is just €5.

Trade Republic: Frequently Asked Questions

Are my money safe at Trade Republic?

Yes. Trade Republic is a fully-licensed financial institution registered in Germany, meaning that the company is frequently audited and is subject to numerous regulations. In addition, the funds in your cash account are safeguarded by the Deposits Protection Scheme for an amount of up to €100'000 per customer. The securities and various assets are not covered because they are your property that is deposited into a custodian bank (HSBC Germany), as required by law.

Is Trade Republic safe and trustworthy?

Trade Republic is a financial institution supervised by the Federal Bank of Germany as well as BaFin (Federal Financial Supervisory Authority). This means that not only are your funds safe when held at Trade Republic, but you can also enjoy all the protections granted by various German laws that are notoriously pro-consumer and pro-privacy.

What do I need to open a Trade Republic account?

There are just a few simple criteria you must satisfy to open a Trade Republic account and start trading today:

- You are at least 18 years old

- You permanently reside in one of the countries supported by Trade Republic

- You have a phone number and a bank account in your country of residence

How long does opening a Trade Republic account take?

You only need to provide basic information about yourself (like your name, email and a phone number) and complete a standard fully-digital automatic identity verification process to start trading. Combined, it usually only takes 5 to 10 minutes to be up-and-running with Trade Republic.

Is it possible to create a joint account at Trade Republic?

No, it is not possible to create a shared Trade Republic account. This is a legal requirement imposed on licensed financial institutions - securities and digital assets should have a single owner. If you want to start budgeting or saving together, we invite you to take a look at our selection of the best joint bank accounts.

How do I deposit money in my Trade Republic account?

There are multiple account top-up options available:

- Bank transfer from a SEPA bank account

- Apple Pay & Google Pay

- Using a credit card (debit cards are also an option)

Please note: when performing a bank transfer, the original account has to belong to you. Transfers from joint accounts are accepted as well, but deposits from business bank accounts are not possible.

What are the deposit fees at Trade Republic?

Your first deposit via bank transfer is free of charge. After that, each deposit incurs a 0,7% fee that is applied on top of the desired deposit amount. For example, when depositing €100,00 into your Trade Republic account, the actual amount withdrawn from your bank account is €100,70.

For account funding via credit & debit cards, the fee varies and is displayed clearly when starting the flow in your app.

What is the minimum and maximum deposit at Trade Republic?

The smallest amount you can deposit into your account is just €10. The maximum deposit (deposit limit) is set at €50'000 per account per quarter. At this moment, it is not possible to increase this limit.

How do I withdraw money from a Trade Republic account?

You can withdraw money from your Trade Republic account at any time with no restrictions. The funds will then be transferred to your reference account number you can see on your profile page in the app.

How long does withdrawing money from Trade Republic take?

The exact amount of time it takes for your withdrawal to appear in your bank depends on your bank and when the withdrawal request is submitted. In most cases, you will see your money within 1-3 business days. Generally, the way to get the fastest withdrawal is by requesting these on weekdays before noon - that means it most likely goes into the daily batch of payments Trade Republic sends their bank for execution that day.

What countries is Trade Republic available in?

You can sign up for a Trade Republic account as long as are a resident (or a national) of any of the following 17 countries: Germany, Austria, Netherlands, Ireland, Luxembourg, Belgium, Finland, France, Italy, Spain, Slovakia, Slovenia, Lithuania, Latvia, Greece, Portugal, Estonia.

Trade Republic: Alternatives

Looking for an alternative to Trade Republic? We carefully selected these three platforms based on preferences and feedback of thousands of users and opinions of our experts in financial services industry. Looking for more? Make sure to explore our curated list of investment platforms and apps or explore our collection of ratings and reviews.

BUX Zero

Founded in 2014 and publicly launched in 2019, BUX quickly got an impressive following by providing users a very convenient, jargon-free and transparent product. BUX Zero is available in 8 countries in Europe and boasts very low (zero in some cases!) transaction fees.

- Convenience & User-friendliness

- Customer Support

- Features Available

- Trading Fees

- Asset Selection

- Overall Rating

Vivid

Vivid is an up-and-coming financial "one-stop-shop" app: payments and transfers, an interest on your current account, 3000+ ETFs & stocks from companies all over the world along with 50+ cryptocurrencies on top of and an ability to store funds in over 40 currencies.

- Convenience & User-friendliness

- Customer Support

- Features Available

- Trading Fees

- Asset Selection

- Overall Rating

Bitpanda

Bitpanda is an "all-in-one" investment platform which allows you to trade stocks, ETFs, commodities, cryptocurrencies and crypto indices - all in one simple app. Execute trades starting as low as €1 and use a Bitpanda Visa card to pay with crypto while earning cashback.

Active Promotion for FC Visitors: Get €5 in BEST for free!

- Convenience & User-friendliness

- Customer Support

- Features Available

- Trading Fees

- Asset Selection

- Overall Rating

Is Trade Republic a good choice for a retail investor?

Summarizing everything we mentioned in our in-depth review, Trade Republic is a great choice for retail investors who do not want the hassle of the more complex instruments. The platform can be positioned at a convenient intersection where it has simple user interface that’s easy to get started with, while offering more advanced investment products like ETFs and derivatives.

Therefore, we view Trade Republic as an investment app you can realistically stay with in the long run, considering both the portfolio of investment products and security aspects. While there are some gaps present right now, we do see great things on the horizon for Trade Republic.

The investment platform application, scoring a great 4.2 stars on Trustpilot, is available on mobile (iOS and Android) as well as on desktop through web browser login. The apps have a clear minimalist design and it should take you almost no time to start feeling confident when navigating them.

If you're keen to explore different types of investment products or plan to develop a habit of investing long-term, we certainly recommend you give Trade Republic a go. There’s no learning curve to the platform and no setup fees are required to get started either. At the time of review, Trade Republic awards new customers in Germany a free share when they sign up.

⚠️ Warning! Investment is never without risk. You may lose your investment due to market risks involved. ⚠️